EUR/USD Pip Calculator: How Much Is 1 Pip Worth & How to Calculate It Manually (With INR Example)

The EUR/USD pair maintains its position as one of the most actively traded currency pairs throughout the world. The value of one pip in the EUR/USD pair remains a mystery to many traders. The value of one pip in your local currency, such as INR holds greater significance than the initial question. The following guide provides the information you need. The guide explains manual pip value calculations through examples and demonstrates how to convert pips into Indian rupees for accounts that use the INR currency.

Table of Contents

-

- Use Our EUR/USD Pip Calculator

- What Is a Pip in EUR/USD?

- How to Calculate EUR/USD Pip Value Manually

- Why Pip Value Matters

- Real-World EUR/USD Scenario (India)

- EUR/USD Pip Calculator + Risk Management

- Visual Guide: Pip Value vs Lot Size

- Recommended Strategies

- FAQs – EUR/USD Pip Calculator

- Related Tools

- Sources

Use Our EUR/USD Pip Calculator

You can quickly find the value of 1 pip in micro, mini, or standard lots. Works with INR, USD, EUR, and GBP.

Here is our Pip Calculator that you can use. You can find many more currency pairs there as well.

[pip_profit_calculator]

What Is a Pip in EUR/USD?

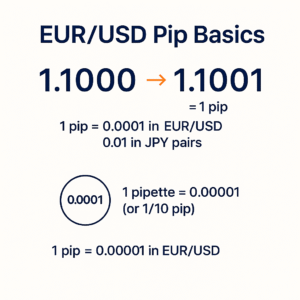

A pip stands for “percentage in point” and represents the smallest standardized change in the exchange rate of a currency pair.

-

-

- In most forex pairs (like EUR/USD), 1 pip = 0.0001.

- Example: If EUR/USD moves from 1.1050 to 1.1051, that’s a 1 pip move.

- JPY pairs use 0.01 per pip (not applicable here).

- A pipette is 1/10th of a pip (fifth decimal place). Example: 1.10507 → 1.10512 equals 0.5 pipettes.

-

How to Calculate EUR/USD Pip Value Manually (Step-by-Step)

Formula (USD is the Quote Currency)

Pip Value (USD) = (Lot Size × 0.0001) ÷ EURUSD price

Then convert to INR if needed using the current USD/INR rate.

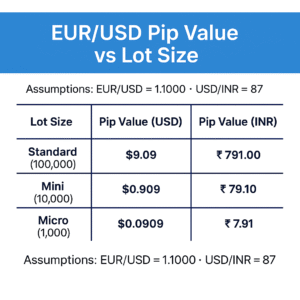

Worked Examples Worked Examples (Assume EUR/USD = 1.10; USD/INR = 87)

| Lot Type | Units | Pip Value (USD) | Pip Value (INR) |

|---|---|---|---|

| Standard | 100,000 | $9.09 | ₹791.00 |

| Mini | 10,000 | $0.909 | ₹79.10 |

| Micro | 1,000 | $0.0909 | ₹7.91 |

Check: (100,000 × 0.0001) ÷ 1.1000 = 9.09 USD; then 9.09 × 87 = ₹791.

Why Pip Value Matters in EUR/USD Trading

-

-

- Profit & Loss (P/L): Each pip directly impacts P/L.

- Stop-Loss Sizing: Translate chart distance into money at risk.

- Risk per Trade: Align with fixed risk models (e.g., 1–2% of account).

-

Example: Risking 50 pips on a standard lot at ₹791/pip = ₹39,550 risk.

Real-World EUR/USD Trader Scenario (India)

A trader with a ₹2,00,000 account risks 2% = ₹4,000.

-

-

- Stop-loss: 30 pips

- Required pip value: ₹4,000 ÷ 30 = ₹133.33 per pip

- Closest is a mini lot (~₹79.10/pip). To reach ₹133.33/pip, trade ~0.17 standard lots (≈17,000 units) or use a position size calculator.

-

Note: Broker minimum lot increments may affect exact sizing.

EUR/USD Pip Calculator + Risk Management

Here are some additional tools you can use alongside Pip Calculator to add risk management and know the risk of your portfolio:

Visual Guide: EUR/USD Pip Value vs Lot Size

Assumptions: EURUSD = 1.1000 · USD/INR = 87

| Lot Size | Pip Value (USD) | Pip Value (INR) |

|---|---|---|

| Standard (100,000) | $9.09 | ₹791.00 |

| Mini (10,000) | $0.909 | ₹79.10 |

| Micro (1,000) | $0.0909 | ₹7.91 |

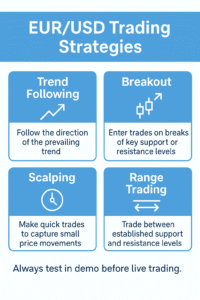

Recommended Strategies for EUR/USD Traders

Many professional traders use proven forex trading strategies to stay consistent and manage risk. Below are some of the most commonly used strategies for EUR/USD trading, with explanations and further resources to help you go deeper. Keep in mind that a lot of these strategies are deeper, and you can absolutely find more material on them to read.

-

-

- Trend Following: The strategy requires traders to determine the dominant market trend direction between uptrend and downtrend for entering trades that follow the established direction. Traders use three methods to confirm their entries including the 50/200-DMA cross and MACD and price structure analysis of higher highs and higher lows. The fundamental principle requires traders to track market momentum while they should prevent themselves from making trades that fight against the current trend.

Moving averages primer (Investopedia) - Breakout Strategy: The price breaks through essential support or resistance areas while showing rising market activity and volatility which results in breakouts. Traders set their stop orders at levels above the zone to benefit from the price increase when new market orders start entering the market. The EUR/USD market experiences its peak liquidity during the EU–US session overlap while major macroeconomic news events such as ECB/Fed announcements and CPI and NFP releases occur.

Guide to breakout trading (Investopedia) · - Scalping: The strategy uses high-frequency short-term methods to detect small pip movements during each trading session. Scalpers require tight spreads together with fast execution and strict risk controls which should include 3–8 pip stops. The high liquidity of EUR/USD makes it suitable for scalping during major liquidity windows yet traders should be cautious about slippage during news releases.

Scalping explained (Forex.com) ·

Scalping overview (Investopedia) - Carry Trade: This strategy takes advantage of interest rate differences by borrowing at low interest rates in one currency and investing in a currency with higher interest rates while receiving the overnight swap. The carry strategy remains less significant in EUR/USD than in other currency pairs until the ECB and Fed implement different monetary policies. Always check your broker’s swap rates and the macro backdrop.

Carry trade overview (Investopedia) · - Range Trading: The EUR/USD price moves horizontally between two levels when there is no established trend direction. Range traders buy at support levels and sell at resistance levels while using RSI/Stochastics indicators to determine their entry points. The trading method performs better during times of low market volatility which occur during specific times of the Asian session..

Range trading basics – Investopedia

- Trend Following: The strategy requires traders to determine the dominant market trend direction between uptrend and downtrend for entering trades that follow the established direction. Traders use three methods to confirm their entries including the 50/200-DMA cross and MACD and price structure analysis of higher highs and higher lows. The fundamental principle requires traders to track market momentum while they should prevent themselves from making trades that fight against the current trend.

-

Tip: Each strategy needs to undergo backtesting and forward-testing on a demo account. Your position sizing and risk per trade and trade frequency should match your edge and psychology.

FAQs – EUR/USD Pip Calculator

How much is 1 pip worth in EUR/USD?

Roughly $10 per pip for a standard lot, $1 for a mini lot, and $0.10 for a micro lot when EURUSD ≈ 1.00. At EURUSD = 1.10, the USD value per pip is slightly lower (e.g., $9.09 for a standard lot) due to the formula (Lot Size × 0.0001) ÷ EURUSD price. Convert to INR using USD/INR (e.g., × 87).

How do I calculate pip value manually?

Use (Lot Size × 0.0001) ÷ EURUSD price to get the pip value in USD. Then multiply by the USD/INR rate (assume 87 in this guide) to get pip value in INR. Example: Standard lot → (100,000 × 0.0001) ÷ 1.1000 = $9.09; $9.09 × 87 = ₹791.

Does pip value stay constant?

No. Pip value varies with the EURUSD price (the denominator in the formula) and your lot size. As price changes, so does the pip value; always re-check before sizing trades, especially around volatile events (e.g., NFP, CPI, central bank decisions).

Can I use pip value for risk calculation?

Yes. Use Pips risked × Pip Value to get the money at risk. For example, 30 pips risk × ₹79.10/pip (mini lot) = ₹2,373. Combine this with a position size calculator and a risk-reward ratio for consistent risk management.