BTC/USD Pip Calculator: Accurately Measure Crypto Pip Values in 2025

The following guide provides instructions to calculate pip values for Bitcoin trading activities. The BTC/USD pip calculator provides Bitcoin traders with precise calculations through its support for INR and USD account types. The guide explains Bitcoin pips through definitions and manual calculation methods while showing their impact on actual trading operations.

Table of Contents

- What is a Pip in BTC/USD Trading?

- BTC/USD Pip Calculator Tool (Mobile-Optimized)

- How to Manually Calculate Pip Value in BTC/USD

- BTC/USD Pip Impact on Real Trading Strategies

- Why BTC/USD Pip Value Matters

- Recommended Strategies for BTC/USD

- Frequently Asked Questions (FAQs)

- Related Tools for BTC Traders

- Data Sources & Accuracy

What is a Pip in BTC/USD Trading?

Definition of a Pip in Cryptocurrency

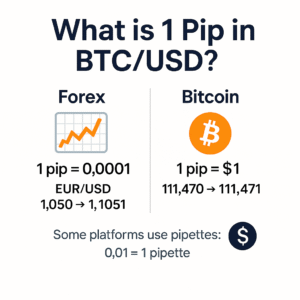

In traditional forex pairs, a pip is usually the fourth decimal place (0.0001). For crypto pairs like BTC/USD, pricing is quoted in dollars, so the convention is different:

- 1 pip in BTC/USD = $1.00 change in price.

- Example: If BTC/USD moves from $111,470 to $111,471, that equals 1 pip.

Pip vs. Pipette in Crypto

Some platforms quote BTC/USD with two decimal places (e.g., 30000.75). In that case:

- 0.01 = 1 pipette (1/100th of a pip).

- On many major exchanges (e.g., Binance, Bybit), the pip convention is $1.00.

BTC/USD Pip Calculator Tool (Mobile-Optimized)

[pip_profit_calculator]

Input Fields

- Trade Size (in BTC): e.g., 0.1, 0.5, 1

- Entry Price: e.g., $29,800

- Account Currency: USD or INR

Output

- Pip value in account currency

- Profit/Loss for a 10 pip move

- Pip size (constant: $1)

Example (USD account):

Trade size = 0.5 BTC; price moves from $30,000 to $30,010 (10 pips).

P/L = 0.5 × 10 × $1 = $5.

Example (INR account, 1 BTC):

1 pip = $1 × 87 (USD/INR) = ₹87 → 10 pips = ₹870 per BTC.

How to Manually Calculate Pip Value in BTC/USD

Formula for Pip Value

Pip Value (USD) = Trade Size (BTC) × Pip Size ($1)

Worked Examples

- 0.1 BTC = 0.1 × $1 = $0.10 per pip

- 1 BTC = 1 × $1 = $1.00 per pip

- 5 BTC = 5 × $1 = $5.00 per pip

INR conversion (USD/INR = 87):

1 BTC = ₹87 per pip · 5 BTC = ₹435 per pip.

BTC/USD Pip Impact on Real Trading Strategies

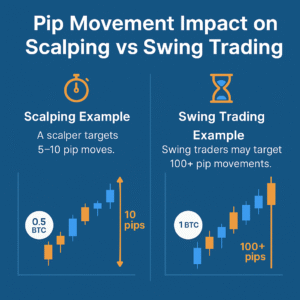

Scalping Example

Scalpers focus on 5–10 pip moves when market liquidity is high. The profit/loss calculation for a 0.5 BTC position during a 10-pip move equals $5 (≈ ₹435 at 87/USD). The system depends on tight spreads and fast execution for its small and frequent trading operations.

Swing Trading Example

Swing traders aim to achieve profits exceeding 100 pips. A 1 BTC position with a 100-pip move results in P/L = 1 × 100 × $1 = $100 (≈ ₹8,700). The knowledge of pip value enables traders to establish appropriate stop-loss and take-profit positions.

Why BTC/USD Pip Value Matters

Risk Management

Your per-pip value determines how you should position size and set stop-loss levels. You should convert pips to your account currency (e.g. INR) to maintain risk consistency between different trading setups when risking 1% of equity per trade.

Cross-Market Context (Forex vs Crypto)

In forex (e.g., EUR/USD), 1 pip = 0.0001. In BTC/USD, 1 pip = $1. The large absolute value of Bitcoin price enables small crypto pip movements to generate substantial profit and loss even when trading with minimal BTC amounts.

Recommended Strategies for BTC/USD

Here are common crypto trading strategies used with BTC/USD. Test them in a demo, then apply strict risk rules before going live.

- Breakout Momentum: Trade range breaks or consolidation breakouts when volatility expands (e.g., after news or during US session open). Use confirmation, such as volume spikes or momentum indicators.

Breakout primer – Investopedia - Trend Following: Identify higher-timeframe direction (e.g., 4H/D) using moving averages (50/200 EMA) or market structure. Enter on pullbacks and trail stops behind swing levels.

Trend Following – Tradingview - Range Trading / Mean Reversion: In sideways markets, buy near support and sell near resistance; use oscillators like RSI for timing. Place tight stops outside the range to avoid false breaks.

Range trading basics – Investopedia - News & Event-Driven: Trade around catalysts (Fed/ECB decisions affecting USD liquidity, major ETF flows, halving cycles). Expect higher slippage; reduce size and widen stops.

Crypto market basics – Investopedia - Risk-First Position Sizing: Use a fixed R model (e.g., risk 1% per trade) and calculate BTC size from stop distance in pips. This keeps outcomes consistent across setups.

Risk-First Position Sizing

Frequently Asked Questions (FAQs)

How much is 1 pip in BTC/USD worth?

What is the pip value in INR for 1 BTC?

Is pip calculation different in crypto vs forex?

Does BTC size (lot size) change pip value?

Why should Indian traders care about pips?

Related Tools for BTC Traders

Data Sources & Accuracy

Our pip logic follows common BTC/USD market conventions across major exchanges. Currency conversion examples use a fixed USD/INR = 87 for this guide. For live rates, refer to reliable providers.