How to Calculate Pips in Gold (XAU/USD): Step-by-Step Guide with INR Examples

The complete XAU/USD guide provides Indian traders with everything they need to master gold trading pip calculations. The guide explains what a pip in gold represents while providing the pip value formula and converting results to INR currency using the USD/INR exchange rate of 87 and demonstrating trading examples that range from scalping to swing trading.

Table of Contents

What Is a Pip in Gold Trading?

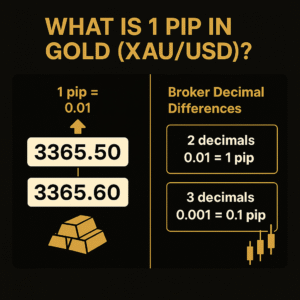

For XAU/USD (gold priced in US dollars per troy ounce), a pip is the smallest standardized price change used by most forex/CFD brokers. The convention is:

- 1 pip = 0.01 change in price (one US cent per ounce).

- Example: Example: If XAU/USD moves from 3365.50 to 3365.60, that equals 1 pip.

The value of pips in gold trading stands as a critical factor because gold markets experience greater price fluctuations than major currency pairings. The market shows typical daily price movements between 100 and 300 pips which results in significant profit or loss for all trading positions. Traders need to calculate pip value before they can set stop-loss and take-profit levels.

[pip_profit_calculator]

Broker Decimal Differences

The price quotation of gold varies between brokers who use two decimal places (0.01) and those who use three decimal places (0.001). Before trading, always check your broker’s contract specifications or review the MT4/MT5 Market Watch symbol properties.

| Decimal Quote Format | 1 Pip Equals | Notes |

|---|---|---|

| 2 decimals (e.g., 1975.45) | 0.01 | Standard pip convention for XAU/USD |

| 3 decimals (e.g., 1975.457) | 0.1 pip per 0.001 (often called a “point” or pipette) |

Check how your platform labels “point” vs “pip” |

Pip Value Formula for Gold (XAU/USD)

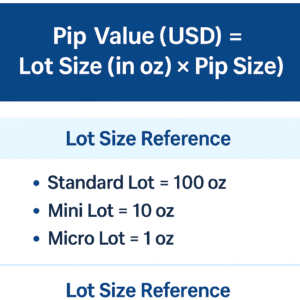

Pip Value (USD) = Lot Size (in oz) × Pip Size (0.01)

Lot Size Reference

- Standard Lot = 100 oz

- Half Lot = 50 oz

- Mini Lot = 10 oz

- Micro Lot = 1 oz

Quick Formula Cheat Sheet

- Pip Value (INR) = Lot Size (oz) × 0.01 × USD/INR

- With USD/INR = 87:

INR Pip Value = Lot Size × 0.87

Manual Calculation Examples

Example 1 – Standard Lot (100 oz)

- Pip Value (USD): 100 × 0.01 = $1.00 per pip

- Pip Value (INR): $1 × 87 = ₹87 per pip

- 20-pip move: $20 = ₹1,740

Example 2 – Mini Lot (10 oz)

- Pip Value (USD): 10 × 0.01 = $0.10 per pip

- Pip Value (INR): $0.10 × 87 = ₹8.70 per pip

- 50-pip move: $5 = ₹435

Example 3 – Micro Lot (1 oz)

- Pip Value (USD): 1 × 0.01 = $0.01 per pip

- Pip Value (INR): $0.01 × 87 = ₹0.87 per pip

- 200-pip move: $2 = ₹174

Real Trade Scenarios (INR)

Scenario 1 – Scalping 50 oz

- Pip Value: 50 × 0.01 = $0.50 = ₹43.50 per pip

- 10 pips: $5 = ₹435

Scenario 2 – Swing Trading 100 oz

- Pip Value: ₹87 per pip

- 35 pips: $35 = ₹3,045

Scenario 3 – Conservative Beginner, 5 oz

- Pip Value: 5 × 0.01 = $0.05 = ₹4.35 per pip

- 100-pip stop: $5 = ₹435 risk

Risk Management Using Pip Value

Stop-Loss Calculation by % of Equity

Convert pips to rupees before placing a trade. Example with a ₹200,000 account, risking 1% (₹2,000):

- Trading 100 oz (₹87/pip): Max stop =

₹2,000 ÷ ₹87 ≈ 23 pips - Trading 25 oz (₹21.75/pip): Max stop =

₹2,000 ÷ ₹21.75 ≈ 92 pips

Choose the lot size and stop distance that keep your rupee risk within plan.

Common Mistakes

- Ignoring broker decimals (0.01 vs 0.001) and misreading pips/points.

- Setting a stop (e.g., 100 pips) without first computing INR risk.

- Using the same lot size across trades with different volatility regimes.

Use with Position Sizing

Combine pip value with a Position Size Calculator and a Risk–Reward Tool to standardize results.

Comparison Table – Lot Size vs Pip Value

| Lot Type / Size | 1 Pip (USD) | 1 Pip (INR @ 87) | Risk per 100 pips (INR) |

|---|---|---|---|

| Micro – 1 oz | $0.01 | ₹0.87 | ₹87 |

| Mini – 5 oz | $0.05 | ₹4.35 | ₹435 |

| Mini – 10 oz | $0.10 | ₹8.70 | ₹870 |

| Quarter – 25 oz | $0.25 | ₹21.75 | ₹2,175 |

| Half – 50 oz | $0.50 | ₹43.50 | ₹4,350 |

| Standard – 100 oz | $1.00 | ₹87.00 | ₹8,700 |

Recommended Strategies for XAU/USD

Gold (XAU/USD) is liquid and news-sensitive. These popular trading strategies pair well with clear pip value math:

- Breakout Trading: The market requires traders to establish new support and resistance levels when volatility increases during Federal Reserve announcements and US Consumer Price Index and Non-Farm Payrolls reports. Traders should confirm their trades with volume and momentum indicators and set stop-loss orders at specific pips distances from the breakout point. Breakout primer – Investopedia

- Trend Following: The 4H/D charts require direction identification through either 50/200 EMA or market structure analysis of higher highs and lows. Enter pullbacks; trail stops by swing lows/highs measured in pips. Trend Following – Tradingview

- Range Trading: The strategy for consolidation requires buying at support levels and selling at resistance levels. The timing of reversals becomes possible through Oscillators (RSI/Stochastics) while stops should be placed at a specific number of pips beyond the range. Range trading basics – Investopedia

- Scalping:

The focus should be on 5–20 pip bursts during London/NY overlaps. Tight spreads and fast execution are critical. Always pre-define pip risk and size down during news.

- News/Event-Driven:

The price of gold reacts to three main factors which include USD strength and real yields and geopolitical events. The trading events require traders to decrease their position size while increasing stop-loss distances in pips to handle potential price slippage.

FAQs

How much is 1 pip in gold?

What’s the pip value for 10 oz?

Do brokers quote gold the same way?

Can I calculate gold pip value in INR?

How volatile is gold in pips per day?

Final Thoughts

Understanding gold pips (XAU/USD) helps you translate charts into rupee risk, size positions realistically, and avoid over-exposure. Before every trade, confirm your broker’s decimal format, compute pip value in INR, and use a consistent risk-per-trade model.

Bookmark this guide and try our tools: Gold Pip Calculator · Position Size Calculator · Risk–Reward Tool

Sources